Billing a user and paying bills

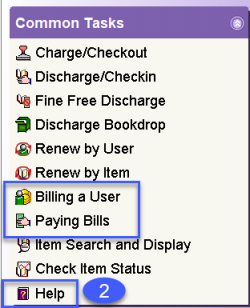

The Billing a User and Paying Bills Wizards are found in the Common Tasks wizard group.

Procedure for collecting money for an item that is not yet billed

Complete the following procedure when a patron wants to pay for an item that has not yet been billed. If the patron is not paying for the item, leave it on the patron’s record. The patron will receive the normal LOST bill at 42 days overdue.

Open the Display User wizard

Look up your patron using the Display User wizard

- Click on the Checkouts tab and find the item that has been lost or damaged

- Click on the glossary for the Item ID

- Once the glossary opens, highlight the Item ID and copy it

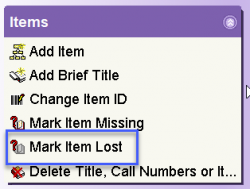

Open the Mark Item Lost wizard

The Mark Item Lost wizard can be found in the Items wizard group.

- Enter the Item ID in the search field or select the Current Item, if it is the item you are marking lost

- Click Mark Item Lost

- Click Bill User and OK on the next screen and Close.

Do not click the Cancel Bill button, that will skip the bill process

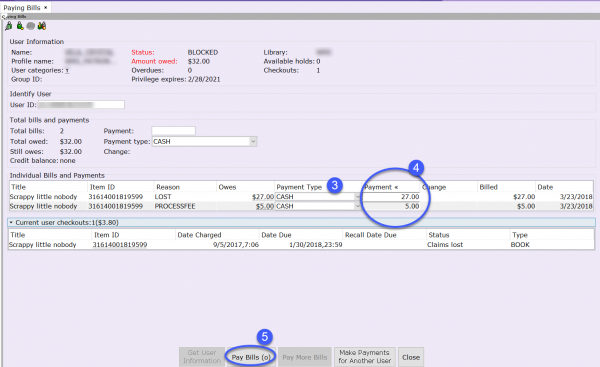

Open the Paying Bills wizard

The Paying Bills wizard can be found in the Common Tasks wizard group.

- Enter the patron’s User ID

- Highlight the bill in the list of bills

- Select the payment type

- Enter the payment amount on the line for the lost item and processing fee

- Click Pay Bills.

- The screen will then display the amount paid.

Waiving fees & fines

If your library allows you to waive bills, use the FORGIVEN or WAIVE payment type.

For RB/ILL Items, your library will be debited even though the user isn’t paying

Fines calculations

Fines are accrued by the daily fine rate times the number of days overdue. A maximum fine will be 42 days times the daily fine rate unless that number exceeds $42.

Best Practices

- Round prices to the nearest dollar when possible